VAT in Germany

What is VAT?

One might wonder about the name “VAT”. Though consumers don’t receive any direct benefit by paying an additional 7% or 19% on top of the net price, the name stems from the value added principle in effect since 1968. According to this principle, businesses pay VAT only on the added value achieved. This added value represents the difference between your purchase price and the sales price the end customer pays.

In Germany, smaller businesses can opt to be exempt from VAT obligation and can issue invoices without including VAT. However, it’s important to note that in such cases, businesses won’t receive a refund for any input tax they’ve previously paid. Essentially, if a business doesn’t pay VAT to the tax office, it can’t report previously VAT paid as a negative and claim a refund.

German VAT Rates

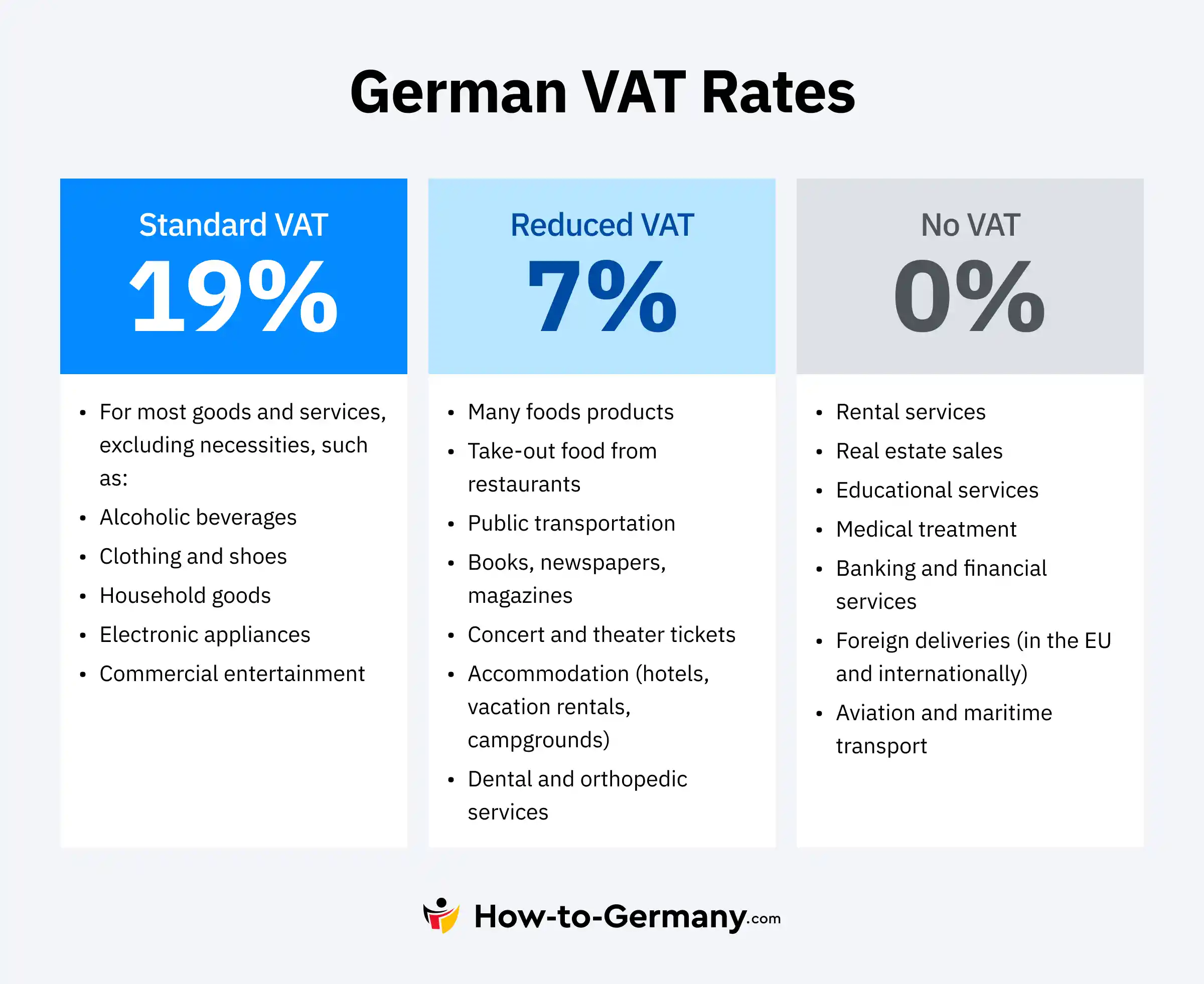

German tax law specifies three distinct VAT rates. The most common, known by most consumers, is the 19% rate. Some goods and services, however, benefit from a reduced rate of 7%. This lower rate is designed to alleviate the financial impact on consumers for certain essential purchases. Some businesses also use an intermediate tax rate, although this is less common.

The applicable rate often depends on the nature of the service or product provided. To illustrate, beverages are generally taxed at 19%, the standard VAT rate. However, milk, being a food item, is only taxed at 7%. Surprisingly, despite being a basic necessity, mineral water is taxed at 19%.

The 7% reduced rate applies to items such as:

- Some groceries

- Take away food

- Newspapers

- Magazines

- Books

- Local public transport

- Stays at hotels or campsites

- Entry to concerts, theaters, and museums

- Copyrighted services, including articles and graphics

- Performances by artists

Certain services and transactions are exempt from VAT, including:

- Medical treatment and nursing services

- Real estate sales

- Real estate rentals and leasing.

German VAT Number

Known as the VAT ID in English, the Umsatzsteuernummer (USt-IdNr.) in German serves as an identification number exclusively for businesses dealing with sales tax. It follows the format DE123456789. It’s essential to distinguish this from the general tax number or the tax ID.

VAT or Sales Tax?

For entrepreneurs, tradespeople, self-employed individuals, freelancers, and service providers, what we call VAT is synonymous with sales tax, known in German as Umsatzsteuer (USt.).

Both terms, “VAT” and “sales tax,” describe the same concept. The preference for the term “sales tax” over “VAT” in some contexts arises because there exists a sales tax law (UStG) in Germany, but no specific law named after value-added tax (VAT). Both terminologies denote the indirect tax added to the value of a product, and all businesses are required to transfer the respective amount to the tax office.

VAT splits into two categories: sales tax and input tax. When a business sells a product or service, it charges sales tax, which the consumer pays. Conversely, when you, as a business owner, purchase an item from a vendor, you pay input tax, known in German as Umsatzsteuerschuld.

VAT Returns for Entrepreneurs

If you’re an entrepreneur in Germany, you’re also subject to taxation. You must declare the tax amount to the responsible tax authority and ensure its payment. This entails submitting preliminary VAT returns to the tax office, a requirement for all self-employed individuals, regardless of your business type, be it commercial or freelance.

Typically, VAT should be paid quarterly to the tax office. However, if your annual VAT liability exceeds €7,500, reports have to be filed monthly. On the other hand, if it’s below €1,000, an annual return suffices.

Start-ups or new businesses are required to report VAT monthly. This practice is mandatory for the company’s first year and the second one.

Furthermore, by the year’s end, business owners must provide a comprehensive VAT return. This document, submitted alongside the income tax return, acts as a reconciliation for the tax office, offsetting already VAT paid against the total tax amount due.

Save Money with the Small Business Regulation

The small business regulation is a specific rule concerning VAT. Under this guideline, companies with sales that don’t surpass a predetermined threshold are exempt from VAT. Therefore, this means that start-ups and small enterprises won’t have to pay VAT if their revenue remains below this set limit.

To be eligible for the small business regulation, two criteria need to be met:

- The company’s gross annual turnover for the previous year was less than €22,000.

- The estimated gross annual turnover for the ongoing year will not go beyond €50,000.

Once you opt for the small business regulation, you’re bound by its terms for a span of five years. Hence, it’s crucial to forecast your business’s trajectory with accuracy. For many new businesses, a turnover exceeding €50,000 may initially seem ambitious. However, depending on your company sector, this threshold might be achievable faster than anticipated. On the other hand, if you’re pursuing a side business, you could remain under this cap for an extended period. So, it’s wise to evaluate your future business potential thoroughly before committing to this regulation.

New businesses should be aware that some clients or customers in certain sectors may be hesitant to engage with a small business entity. There’s a perception that such companies might lack the required experience or professionalism. And since clients won’t be charged VAT for your services, they can’t deduct VAT from their expenses.

For clarity, when issuing an invoice sans VAT as a small business operator, it’s good practice to add a note: “According to Section 6 (1) Z 27 UStG, the invoice amount is presented without VAT. If my sales surpass the small business regulation threshold, I retain the right to adjust for sales tax.”

Frequently Asked Questions

Partially tax-free turnover refers to businesses that have both taxable and non-taxable sales. In contrast, exclusively tax-free turnover means all the business’s sales are non-taxable under VAT system regulation.

When selling to customers within the European Union, the reverse-charge system can apply. This system means that the buyer, instead of the seller, is responsible for the VAT. Always check with the tax office to ensure you’re following European VAT regulations correctly.

The prior tax deduction system allows businesses to deduct vat they’ve paid on business-related purchases from their vat obligation. This ensures that only the end consumer bears the final cost of the VAT.

Yes, if your business deals with selling properties, you need to be aware of the property pre-tax deduction. However, there are certain tax exemptions related to property transactions, such as residential sales.

Yes, foreign companies that generate taxable turnover in Germany may become a VAT obligated company. It’s crucial for such companies to understand their VAT obligation when trading within Germany.

For foreign events managers or companies supplying services from outside Germany to German consumers, the VAT system regulation requires them to consider vat rates applicable in Germany. It’s especially crucial for electronically supplied services or one off seminar events in Germany from foreign businesses.