How we earn our money

We finance our services on how-to-germany.com through affiliate programs.

When a user orders a financial product through our site and their application is approved, we may receive a commission from some providers. It’s important to note that this does not in any way influence our independent ratings and recommendations.

All the products we present on how-to-germany.com are selected for their quality, range of services, and excellent value for money.

Bank Accounts in Germany

- DKB Current Account – Best bank account in Germany. Suitable for established expats. Requires credit history or permanent residence. Banking app in English.

- ING Current Account – Also great for established expats. Everything in German.

- Commerzbank Current Account – Best bank account at a branch bank. Accepts all nationalities. Banking app and customer service in English.

- Santander BestGiro – Also a great bank account at a branch bank. Everything in German.

- Trade Republic Current Account – Best bank account and broker account combined. Everything in English.

Most banks will offer their websites only in German. Translate the pages using the Chrome browser’s built-in feature (Right-click → Translate to English). If a button or link is unresponsive, switch back to the German version and retry.

Choosing the Right German Bank Account

When selecting a German bank account, it’s crucial to consider factors such as language support, accessibility, fees, and banking preferences. Recently, the German banking market has witnessed the rise of innovative neo-banks, offering attractive features like user-friendly apps, competitive plans, and service in English. However, traditional banks remain popular among locals and expats alike. It’s important to weigh the pros and cons of different banks to find the one that fits your needs best.

Having a German bank account is essential for various purposes, including employment, renting, and insurance policies. A European bank account is also required to receive your salary, pay rent, and pay taxes. In the following sections, we’ll delve deeper into the factors you should consider when choosing a German bank account and present you with the top options available.

Language Support and Accessibility

Language support and accessibility are crucial aspects to consider when selecting a German bank account, especially for expats and English speakers. While many traditional banks in Germany offer English support, they might not provide the same level of convenience as online banks. Online banks typically offer a more user-friendly experience, with many of them providing English customer support and more accessible authentication methods.

Opening an account with some online banks, such as DKB, can be challenging for newcomers. However, other online banks like N26, Tomorrow, and Bunq, which we’ll discuss in detail later, have a more streamlined process for expats and English speakers. These banks often use video identification providers such as IDnow to authenticate the identity of new customers, making the process smooth and efficient.

Fees and Charges

Another vital aspect to consider when choosing a German bank account is the fees and charges associated with the account. Some common fees to be aware of include account management fees (kontoführungsgebühren), credit card fees, and ATM fees. Online banks offer a free basic bank account, which gives users an advantage. Traditional branch banks, however, generally charge a monthly fee.

It’s crucial to compare the fees and charges of different banks to ensure you’re getting the best deal. For example, Commerzbank charges a fee for their credit cards, while some banks offer a waiver of monthly fees if a monthly deposit is made. It’s essential to understand the costs associated with your chosen bank account to avoid unexpected expenses and make the most of your financial transactions.

Banking Preferences

While Germany is gradually moving towards a cashless society, cash remains indispensable, particularly in restaurants and cafés. In 2018, card payments surpassed cash payments for the first time, but it’s still important to consider your banking preferences when choosing a German bank account. One key factor to consider is the availability of ATMs, as they can be limited to specific banks or partner banks, with comparatively lower availability than in other countries.

Debit card usage is another essential aspect to consider. Aldi Süd is the only supermarket offering cashback on Mastercard credit and debit card payments. When selecting a bank account, it’s crucial to ensure that the debit card provided is widely accepted and allows you to withdraw cash from ATMs conveniently.

If you prefer a local branch, traditional banks like Deutsche Bank, Commerzbank, and Postbank may be a better fit for you. These banks have numerous branches across the country, allowing you to visit in person for any banking needs. However, if you’re comfortable with online banking, online and mobile banks like N26, Tomorrow, and Bunq may be more suitable. These banks provide user-friendly apps and digital services, allowing you to manage your finances from anywhere.

Best Online Banks for Expats and English Speakers

For expats and English speakers, online banks like N26, Tomorrow, and Bunq are highly recommended due to their digital sign-up process, competitive prices, and English support. These banks provide a range of services and features tailored to meet the unique needs of expats and English speakers living in Germany.

Let’s take a closer look at each of these online banks and what they have to offer.

N26

N26 is a popular choice among expats and English speakers due to its comprehensive mobile banking experience and English customer support. They offer a variety of bank accounts, including N26 Smart, N26 Standard, and business bank accounts, providing intelligent money management tools, up to 10 Spaces subaccounts, and a direct customer support hotline.

One of the significant advantages of N26 is its fee structure. They do not impose any withdrawal fees, monthly fees, or credit card fees. This makes it an attractive option for those looking to minimize their banking costs while enjoying a seamless mobile banking experience.

To open an N26 account, all you need to do is proceed to mobile banking sign-up and contact customer service.

Tomorrow

Tomorrow is a “bank-with-a-mission” that finances climate-related projects globally. They offer a free checking account with no required monthly input, a free metal Visa debit card, no exchange fees on card payments for up to 40 currencies, and comprehensive real-time control via the app. Additionally, they support both Apple & Google Pay, provide up to fifteen free subaccounts called Pockets with separate IBAN, and do not require a SCHUFA credit check. Opening a free checking account with Tomorrow takes just eight minutes via the app, and it’s accessible to 78 nationalities (USA not accepted).

The wide range of services and features, coupled with their commitment to sustainability, makes Tomorrow an excellent choice for environmentally conscious expats and English speakers. The convenience of their app-based banking experience, coupled with their competitive offerings, makes Tomorrow a top contender among online banks in Germany.

Bunq

Bunq is a digital bank that offers standard banking services such as checking and savings accounts, along with additional functionalities like wire transfers, foreign currency accounts, and a switch service to facilitate the transition to Bunq as the primary account. They provide a free checking account, a free virtual currency card, free currency exchange in 30+ currencies, and comprehensive real-time control via the app. Additionally, Bunq supports Apple & Google Pay and does not require a SCHUFA credit check.

One of the standout features of Bunq is their personalized assistance through their in-app chat. This personal touch, combined with their range of services and features, makes Bunq an excellent option for expats and English speakers looking for a user-friendly and comprehensive online banking experience.

Traditional German Banks for Newcomers

For those who prefer a more traditional banking experience, Deutsche Bank, Commerzbank, Postbank, Sparkasse, and Volksbank are excellent options for newcomers. These banks offer a range of services and features, along with the added benefit of physical branches across the country. However, they often come at a higher price range compared to their online counterparts.

Let’s explore these traditional German banks in more detail.

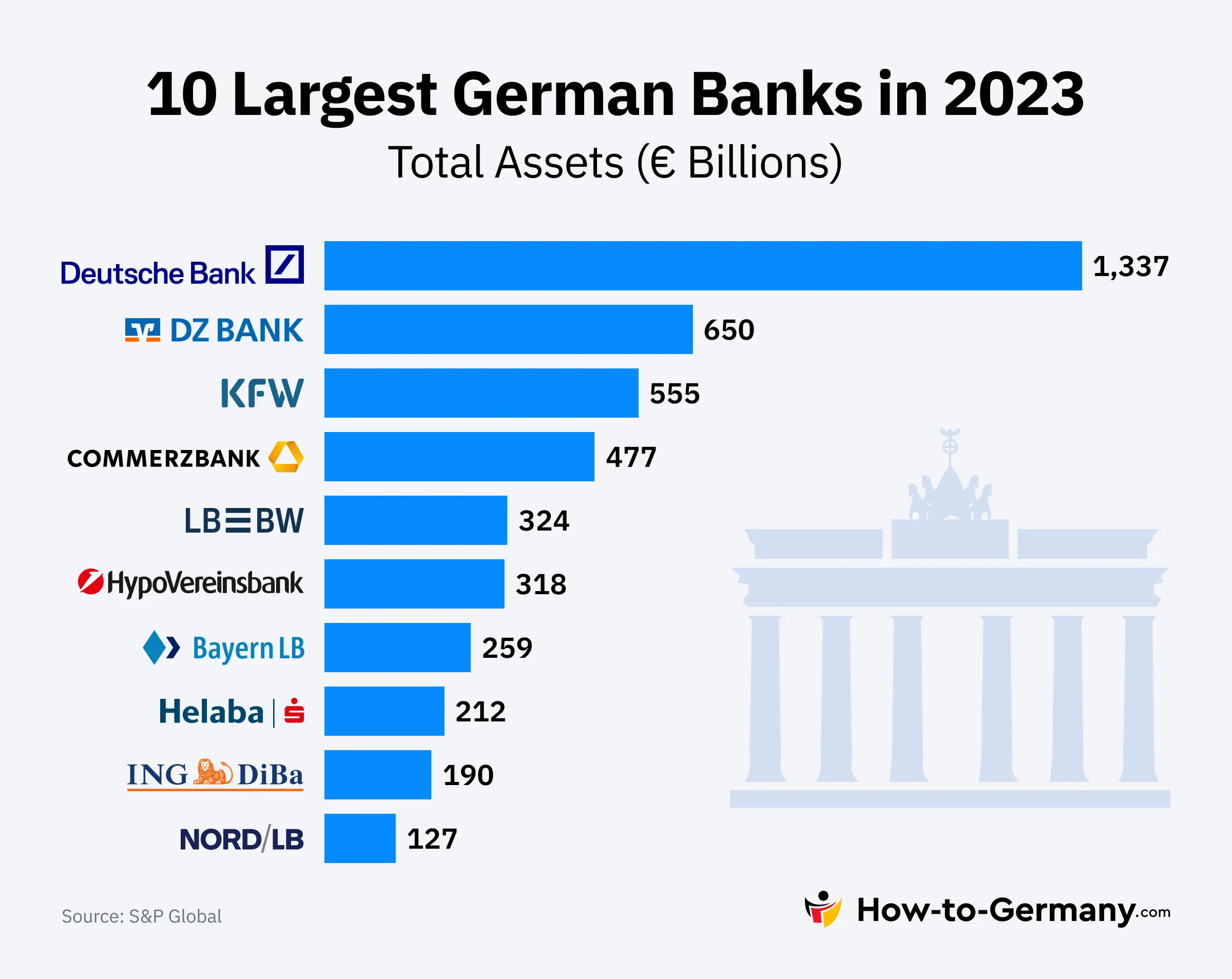

Deutsche Bank

Deutsche Bank is a major German bank that offers a variety of products and services for private customers, corporate clients, asset managers, and institutions, including banking products, investment services, and financial advice. They charge a monthly fee for their current accounts and fees for specific services such as international transfers and cash withdrawals.

Deutsche Bank provides various banking preferences, such as online banking, telephone banking, and customer service hotlines. Their customer support and services make them a reliable option for newcomers looking for a more traditional banking experience in Germany.

Commerzbank and Postbank

Commerzbank and Postbank are two of the largest banks in Germany, offering a wide range of services and features, such as online banking, account transfers, account model changes, and account switching services. Commerzbank’s customers can withdraw cash free-of-charge at Deutsche Bank, Postbank, and Hypovereinsbank ATMs, while Postbank customers can avail of cash withdrawals free-of-charge at Cash Group ATMs, including those of Deutsche Bank, Commerzbank, and Hypovereinsbank.

However, there are fees and charges associated with these banks. For example, Commerzbank charges a fee for their credit cards, and withdrawing funds from a Sparkasse ATM with a Commerzbank account comes with an additional five euros fee. It’s essential to compare the fees and charges of these banks to ensure you’re getting the best deal.

Sparkasse and Volksbank

Sparkasse and Volksbank are two of the largest public-sector banks in Germany, offering a wide range of services, such as current accounts, online banking, ATMs, and payment services like Giropay. Additionally, they provide savings accounts, loans, and mortgages. These banks offer competitive rates and fees while also having a vast network of branches and ATMs across the country, making them convenient for customers.

The primary disadvantage of using Sparkasse and Volksbank is that they are not as technologically advanced as some of the more modern online banking services, and they have limited international banking options. However, for newcomers who prefer a more traditional banking experience, these banks may be a suitable choice.

Specialized Banking Options

In addition to the online and traditional banks mentioned above, there are specialized banking options available in Germany that cater to specific needs. These options include freelancer-friendly banks like Kontist and banks for students such as Fintiba and X-patrio.

Let’s explore these specialized banking options in more detail.

Freelancer-Friendly Banks

Freelancer-friendly banks offer services tailored to meet the unique requirements of self-employed individuals. One such bank is Kontist, which provides a variety of features designed to help freelancers differentiate their business-related transactions from their personal ones. Kontist offers services such as free business bank accounts, services dedicated to self-employed and freelancers, digital bank account services, business loans, international transfers, factoring, and liability insurance.

While freelancers in Germany are not legally required to maintain a separate bank account for their business-related transactions, choosing a freelancer-friendly bank like Kontist can help simplify financial management and ensure a more organized approach to handling business finances.

Banks for Students

Banks for students in Germany provide services such as student accounts, overdraft facilities, credit cards, and student loans. Notable banks for students in Germany include Commerzbank, Deutsche Bank, DKB, Postbank, and N26. Fintiba and X-patrio offer blocked accounts for student visas, which enable students to open a German bank account without having to present proof of residence.

These banks cater to the unique financial needs of students, making it easier for them to manage their finances while studying in Germany. It’s essential to choose a bank that offers specialized services and support for students to ensure a hassle-free banking experience.

Opening a Bank Account in Germany: Step-by-Step Guide

Now that you have an overview of the various banking options available in Germany, let’s take a look at the step-by-step process of opening a bank account. The procedure may vary depending on whether you are selecting an online or physical option, or if you are opening an account from outside the country.

In the following sections, we’ll discuss the required documents and the differences between online and in-person account opening.

Required Documents

To open a bank account in Germany, you will need to provide several documents. These generally include a duly completed application form, a valid passport, a current German residence permit or visa, and proof of registration/address. Some banks may also require additional documents such as proof of income/employment and an initial deposit.

It’s essential to have all the necessary documents ready before you start the account opening process. This will ensure a smooth and hassle-free experience, allowing you to open your German bank account quickly and efficiently.

Online vs. In-Person Account Opening

The process of opening a bank account in Germany can differ depending on whether you choose an online or in-person option. Online account opening is generally more convenient and faster, allowing you to open an account from any location. However, online account opening may require more documents than in-person account opening, and it may be more expensive.

On the other hand, in-person account opening may offer more personalized guidance and generally requires fewer documents and lower costs. However, it can be more time-consuming and inconvenient compared to online account opening.

Understanding the differences between these two options will help you choose the most suitable method for your needs.

Money Transfers and Credit Cards in Germany

Managing your finances in Germany involves more than just opening a bank account. It’s also essential to understand the options available for money transfers and credit card usage in the country.

In this section, we’ll explore cost-effective options for international money transfers and discuss the uncommon use of credit cards in Germany.

International Money Transfers

When it comes to international money transfers, services like Wise can be more cost-effective than using traditional banks. Wise, for example, offers advantageous exchange rates and reduced fees compared to banks. Other cost-effective options for international money transfers to a German bank account include XE.com.

N26 also offers fee-free international money transfers, making it a convenient option for those who need to send or receive money internationally. By utilizing these services, you can save money on your international financial transactions and ensure a smooth and efficient transfer process.

Credit Card Usage in Germany

Credit cards are not as common in Germany as they are in other countries. The most widely accepted credit cards are Visa and Mastercard. There are various types of credit cards available in Germany, such as charge credit cards, revolving credit cards, debit cards, and prepaid credit cards.

Despite the availability of credit cards, cash remains indispensable in many establishments, especially restaurants and cafés. When choosing a bank account in Germany, it’s essential to consider your credit card usage and ensure that the debit card provided is widely accepted and allows for convenient cash withdrawals.

Glossary of Key German Banking Terms

To help you navigate the world of German banking, here’s a glossary of essential German banking terms:

- Konto (Account)

- Geldautomat (ATM)

- Unterschrift (Signature)

- Zinsen (Interest)

- Dauerauftrag (Standing Order)

- IBAN (International Bank Account Number)

Familiarizing yourself with these terms will ensure a smoother banking experience as you navigate your financial journey in Germany.

Conclusion

In conclusion, finding the perfect German bank account depends on your individual needs and preferences. By considering factors such as language support, fees, and banking preferences, you can choose the bank account that best suits your requirements. Whether you opt for an online bank, a traditional bank, or a specialized banking option, this comprehensive guide has provided you with the information you need to make an informed decision. Armed with this knowledge, you’re now ready to embark on your financial journey in Germany with confidence.

Frequently Asked Questions

Yes, foreigners can open a bank account in Germany provided they have the required documents including a valid passport, certificate of registration and wage statement (if applicable). Documents issued abroad must be authenticated by an apostille or legalisation.

From the reviews of experienced expats, N26 appears to be the most recommended option for opening an account in Germany. This bank has a great online banking system and English customer service, making it an ideal choice for those who need an easy and reliable banking experience abroad.

In order to open a bank account in Germany, you will need to have a valid passport, a residence permit, and a certificate of registration. Furthermore, depending on the type of account, you may be asked to provide a wage statement.